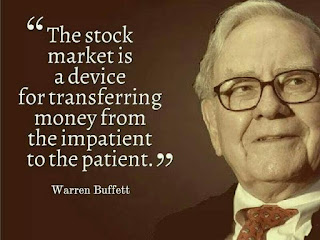

For the impatient investor driven by twitter bursts and the constant media barrage to buy and sell, patience and care are often in short

supply. Despite the low probability of riches

with market timing and the stress it induces, many investors believe cycling

their investments with velocity leads to glory.

And it does. For brokers.

|

| “Steady plodding brings prosperity; hasty speculation brings poverty” – Proverb |

Transactions costs and losses taken when the timing is off

doom investors engaged in frenetic trading activity. Get rich quick schemes prompting the unwary

to buy low and sell high generally result in investors who bought high, sold

low, and suffered transactions costs both ways.

When the house takes you coming, going, and in between, it’s hard to get

ahead!

How do you avoid this nonsense? You buy solid companies paying dividends and

do so at reasonable prices. Then let

time and compound interest work for you.

This plan is even better if you start early and stick with it.

If you recall the Ground post, selecting from Dividend

Champions, Contenders, and Challengers is a great place to find solid companies

at reasonable prices that pay dividends.

You still have to do your homework and wait for those moments when you

discover one of your companies is a fit based on your personal investment

criteria.

After you make your purchase, hold for the long term and

monitor your investment(s) on a regular basis e.g., monthly. DO NOT monitor the hourly, daily, or weekly stock

price. Instead, pay attention to news

articles and announcements about your firm to ensure it isn’t cutting a

dividend, being acquired by a competitor, or suffering accounting irregularities

like Enron.

Aside from catastrophes like these, most media mentions of

your portfolio companies are click bait to move the trading crowd to rash

action. For long-term investors, many

articles are noise and should be treated as such. You just need to be aware of the big events

that could upset the apple cart. Don’t

blink. Don’t panic. Trust the odds are in your favor over the

long haul and against you in the short-run if you’re a frequent trader.

Good ground. Seed

money. Time. Patience and care. Dividend Farming leads to a good night’s

sleep and solid “wake up money”. From an

investment perspective, what’s not to like?

The thoughts and opinions expressed here are those of the author, who is not a financial professional, and therefore should not be considered as investment advice. This information is presented for education and entertainment purposes only. For specific investment advice or assistance, please contact a registered investment advisor, licensed broker, or other financial professional.

The thoughts and opinions expressed here are those of the author, who is not a financial professional, and therefore should not be considered as investment advice. This information is presented for education and entertainment purposes only. For specific investment advice or assistance, please contact a registered investment advisor, licensed broker, or other financial professional.

No comments:

Post a Comment