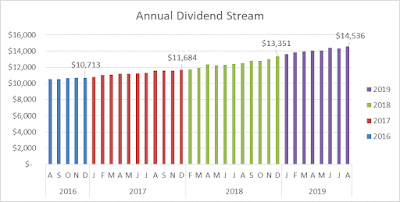

The chart shows the growth of the Dividend Farm’s crop

from August 1, 2016, through August 1, 2019.

For the 3-year period:

- Compound Annual Growth Rate (CAGR): 11.3%

- Average Annual Growth: 11.9%

- Total Growth: 35.8%

Growth from 2016 through the first half of 2018 was exclusively

due to increases in company dividend payments, dividend reinvestment, and the power

of compounding.

Infusions of capital were made in the fall of 2018 and spring

of 2019. These additions helped increase

the slope of the trend line.

Extending this trend to an age where I can take full Social

Security payments means the dividend stream may double – more than twice – to over

$58,000. Although not an enormous

amount, coupling with Social Security, budget

discipline, and little or no

debt results in contented retirement.

It’s not flashy, but it’s working. Dividend Farming is financial pragmatism –

doing what works – even when considered slow or unsophisticated. If the end result is a good night’s sleep,

solid “wake up” money, and limited risk along the way, who cares about flash?

No comments:

Post a Comment