It’s time for the monthly update on my crop’s progress which

is important as a Dividend

Farmer. Since the September update,

there have been no major events adversely affecting my current holdings.

Although I monitor news articles and blogs for activity that

might be unfavorable to my basket of stock, I’m not checking ticker prices on a

daily basis. Doing so invites a level of

consternation I don’t need. Instead, each

investment is reviewed monthly to update dividend increases, price changes, and

increases in stock quantities due to reinvested dividends paid during the month.

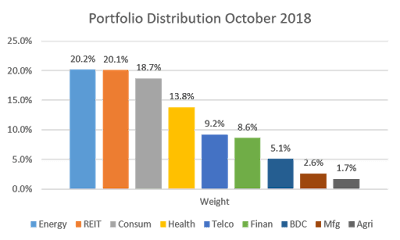

Not many changes relative to last month and no additions to

principle. However, due to dividend

reinvestments in some segments, but not others, the percentages across segments

have shifted slightly. For instance,

REITs were my top holding last month, but slid into second position in

October. Telco and Finance swapped rank

order this month as well.

The yield relative to current price dipped from 3.86% in

September to 3.82% in October due to stock price increases across various

holdings. All dividends are

automatically reinvested with no transactions fees. Unweighted average yield on cost is

approaching 4.6%; nearly 1% higher than yield on price.

The average monthly dividend from this basket is approaching

$1,100. That won’t pay all the bills,

but it’ll put a nice dent in them if needed.

With a trailing 1-year CAGR of 10.6%, the long-term dividend farming

strategy embarked upon 8 years ago is approaching the point of critical mass. If you check out the Compound Growth post

you’ll gain a sense of what I mean.

No comments:

Post a Comment