Tracking my crop’s progress on a monthly basis is an

important part of being a Dividend Farmer.

Although I casually monitor news articles and blogs for major events

that may affect my investments one way or another, I’m not checking ticker

prices on a daily basis. Instead, each

investment is reviewed once a month to record dividend increases, prices

changes, and increases in stock quantities due to reinvested dividend paid

during the month.

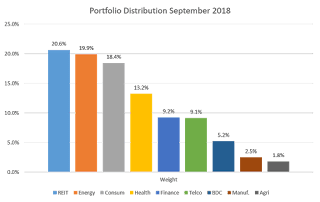

With that in mind, below is the September snapshot of a

portion of my portfolio. I segmented the

group by industry and inserted a simple chart to demonstrate how I’ve allocated

my dividend selections.

Every stock within each category is a dividend payer. With the exception of the BDC segment, each

category contains two to four different holdings.

This basket of stocks has a current dividend yield, relative

to current price, of 3.86%. All

dividends are automatically reinvested with no transactions fees. Because I’ve held most of these investments

for several years, the yield on cost (initial purchase price) is actually .3%

to 1.6% greater than the yield on price.

The higher yield on cost results from dividend increases relative to the

initial purchase price which remains fixed.

The total dividends from this basket is tracking to an

annual run-rate north of $12,000. It took

several years to get here, but now the dividend returns are outstripping

anything I can contribute to my 401K including a company match. For instance, using $12,000, a 3%

contribution, and a 3% company match, my salary would have to be over $200,000

a year to have a similar amount of money injected into my portfolio. I’ll never command that kind of income. Ever.

With a long-term dividend investment strategy leveraging the effects of compounding,

I don’t have to. Neither do you. You just need to get started with the 4Things a Dividend Farmer Needs and work from there. Food for thought…

No comments:

Post a Comment