Have you dreamed of making money without doing

anything? You know, just laying around

the beach with an umbrella drink in hand, knowing money is falling into your

bank account as you lounge in a cabana overlooking the surf? What if the money pouring into your bank

account next week was much greater than the money going in today without so

much as ordering another umbrella drink?

Ah, the life!

Ok, back to reality.

While it may not be as spectacular or compelling as the vignette above, Dividend Farming

does function much the same way thanks to compounding, albeit over a longer

period. Check out the charts below to

see what I mean.

The first chart shows what happens when you start with $10,000

invested in year zero at a rate of 7%.

Your money is compounded annually with a 30-year horizon. Yes, it’s longer than a week, but stick with

me.

|

| 7% Compound Growth Curve |

As you can see, your nest egg has gone from $10,000 to more

than $75,000 during that period. It’s

grown more than 7.5 times and you did nothing; just watched it

grow.

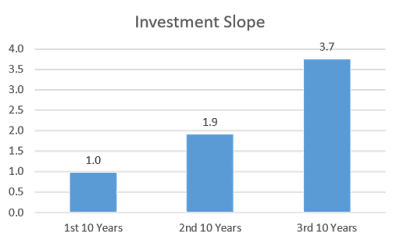

The next 2 charts provide insight into the power of compound

growth by measuring the slope or rate of growth during 10-year intervals along

your investment curve.

In the chart above, I stripped out the investment figures

for the years between 0, 10, 20, and 30 leaving a clean, straight growth line

for each period. With a simplified

curve, I calculated the slope of each 10-year interval as shown in the chart

below. The change in investment value

between any two points was divided by 1,000 to reduce their scale making it easier

to see and understand the differences in slope.

During the first 10-year period, the slope of investment

growth was 1.0. During the 2nd

10-year period, the slope of the line grew to 1.9, nearly doubling. In the 3rd 10-year period, the

slope of the investment growth nearly doubled again, reaching 3.7.

Here’s the key takeaway.

The power of compound growth, like that available with strong,

consistent dividend paying stocks, increases over time. The longer your investment horizon, the

greater the strength you can harness.

Exercising this power requires the patience

of a Dividend Farmer. It doesn’t mean

you’ll be sipping a cool drink on a pristine beach today or tomorrow while

Benjamins pour into your bank account.

However, the power of compound growth available with dividends

automatically reinvested means living that beach life down the road is

possible.

The thoughts and opinions expressed

here are those of the author, who is not a financial professional, and therefore

should not be considered as investment advice.

This information is presented for education and entertainment purposes

only. For specific investment advice or

assistance, please contact a registered investment advisor, licensed broker, or

other financial professional.

No comments:

Post a Comment