|

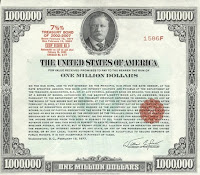

| U.S. Treasury Bond |

Whether you’re discussing Yield to Maturity, Pricing, Tax

Equivalent Yield, Coupons, Duration, Callability, Convertibility, or any number

of other characteristics of the bond world, it’s wise to be conversant in bond

effluvia to avoid the classic “circle the drain” move with your investment

funds.

Below are 6 reasons dividend stocks beat bonds.

- Bond yields move opposite to bond prices. When one goes up, the other goes down. It doesn’t matter which one moves, the other generally moves in opposition. This is a function of the math involved in pricing the bonds as well as the laws of supply and demand in relation to the going rate of interest or yield on similar bonds. Dividend paying stocks may see yields and price moving in opposite directions, but when they do it’s generally because the price of the stock has been bid up while the dividend payment remains unchanged resulting in a smaller yield. It’s not a function of supply / demand and the involved application of algebra that cause the inverse movement.

- Bond valuations are complex. Establishing the value of such investments requires detailed knowledge or analysis of the variables mentioned earlier that go into the formulation of such securities. Dividend paying stocks of large, established firms provide ample financial data and profile information about the company allowing even DIY investors to determine a certain level of value. An investor can decipher the income statement and balance sheet of Parker Hannifin to determine whether the stock price accurately reflects the operations of the company. Conversely, the same investor may undergo a non-trivial level of angst in attempting to understand the true value of a corporate bond with a yield to maturity of X, a duration of 12 years (9 years remaining), sold into a rising interest rate environment, with or without attendant tax consequences.

- Complexity leads to excess fees. Because bonds are complex few laymen understand them. Consequently, investing in bonds requires the assistance of a professional who charges fees for the assistance. Alternatively, substantial losses may be incurred as an investor learns “on the job”, dropping money along the way, because he wanted to avoid the costly professional. When it comes to dividend stock investing, there are plenty of tools readily available to help investors along the path. From DRIPInvesting.org to Yahoo.Finance to Investopedia, the number of low or no-cost resources are too numerous to mention. In addition, it’s easier for an investor to understand what Home Depot does than what’s involved with a municipal general obligation bond, due in 2035, floated 6 years ago by Whatchamacallit County.

- Bond yields are fixed. From the time a bond is floated to the time it reaches maturity or is called, the payment or coupon is rarely if ever increased. Divided paying stocks can and do increase their dividend payments over time. In fact, many companies will raise their dividend payments annually with some having done so many years in a row. As a result, a dividend stock can provide small, regular increases in cash flow while a bond cannot. Case in point, part of my dividend portfolio has seen an average increase in the dividend payment of more than 4% across the investments in that basket during the past year.

- Lender vs owner. They say owning has its privileges. If true, bond purchases make you a lender while dividend stock purchases make you a part owner in the firm. As a part owner, you have voting rights. You get a say in what the company does and how it does it. As a bond holder, you don’t. Granted, as a part owner, you’ll be in line behind the lenders (bond holders) if the firm goes belly up. However, if your decision to invest is based on where you stand in line when the corporate carcass is divided, then maybe you shouldn’t be investing in that firm in the first place.

- Convertability. Some bonds are convertible to stock after a certain period of time. In other words, the lender (see #5) is granted the opportunity to become part owner of the enterprise. Stock holders are not offered the chance to convert their stock to bonds moving from owner to lender. That one-way street should offer pause when considering which is better. Why would I be offered the possibility of converting from a bond to a stock, but not the other way? Maybe because one is better than the other?

|

| James Bond 007 |

The thoughts and opinions

expressed here are those of the author, who is not a financial

professional. Opinions expressed here should not be considered investment

advice. They are presented for discussion and entertainment purposes

only. For specific investment advice or assistance, please contact a

registered investment advisor, licensed broker, or other financial

professional.

No comments:

Post a Comment