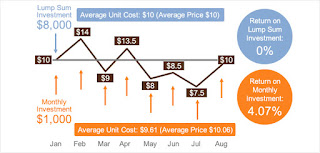

Dollar-cost averaging is an integral part of DividendFarming. It’s a powerful method of growing a great financial crop. The best

part; it’s simple and automatic.

In a nutshell, dollar-cost averaging means contributing an

amount of money to your investment portfolio to purchase stock on a monthly

basis. You could also do so quarterly,

but monthly is advantageous due to the increased number of compounding

periods. The more the merrier, but I

digress. As an example, you might

purchase $100 worth of stock each month and do so irrespective of whether the

stock’s price has increased or decreased.

|

| Courtesy of JP Morgan |

With dollar-cost averaging you may purchase a few shares at

high prices, but you are also likely to purchase more shares at lower

prices. The table below demonstrates the

principle using the $100 example mentioned previously.

Month

|

Share Price

|

Shares Purchased

|

January

|

$25

|

4

|

February

|

$28

|

3.5

|

March

|

$27

|

3.7

|

April

|

$23

|

4.3

|

May

|

$20

|

5

|

June

|

$22

|

4.5

|

TOTAL

|

25

|

You will have purchased anywhere from 3.5 to 5 shares per

month with your $100 investment as long as you were disciplined about putting

money into your brokerage account and making the purchase.

Brokerage Fees and Partial Shares

Realistically, if you were making the purchases with contributions

to your account, the stock purchase figures would be lower because you would

have paid a brokerage fee each time you made a purchase. If a broker charged you $5 for each trade,

you would be investing only $95 per month to buy stock. Consequently, the quantity of stock you buy

each month would be lower than shown.

It should also be noted you can’t buy partial shares this

way. This means another portion of

your $100 would be unavailable to use for purchases each month. This money could be held in the account and

used to supplement your purchase the following month, but you still miss the

full effect of dollar-cost averaging.

The next table offers clarity.

Month

|

Share Price

|

Commission

Fee

|

Funds

Available

|

Shares

Purchased

|

Balance

|

January

|

$25

|

$5

|

$95

|

3.0

|

$20

|

February

|

$28

|

$5

|

$95

|

3.0

|

$6

|

March

|

$27

|

$5

|

$95

|

3.0

|

$9

|

April

|

$23

|

$5

|

$95

|

4.0

|

$3

|

May

|

$20

|

$5

|

$95

|

4.0

|

$10

|

June

|

$22

|

$5

|

$95

|

4.0

|

$7

|

TOTAL

|

21

|

$56

|

In this example, which is more realistic, you would purchase

only 21 shares during the same 6-month period versus the previous case. You would contribute $30 to your broker for

the privilege of making the purchases.

An additional $56 of your $600 in investment funds accumulated in the

account because you can’t purchase partial shares.

Based on the purchase prices shown, you would have to

accumulate the leftover funds for about 3 months before you could use them to

purchase an additional share of stock.

You effectively lost $86 ($30 + $56) or 14.3% of your investment to the

broker or the opportunity-cost associated with not being fully invested each

month.

Ok, if you lose a large chunk of your investment funds in

the dollar-cost averaging example shown, how can that be beneficial to you as a

dividend farmer? When farming dividend

stocks, the dividend payments can be accepted into your brokerage account as

cash and reinvested in additional dividend stock. Managing your dividends this way results in

the kind of attrition highlighted in the second table.

DRIP Strength

However, if you have your dividend payments automatically

reinvested in the companies paying them, you avoid the brokerage fees and

you’re allowed to purchase partial shares.

When you receive $600 worth of dividends and reinvest them in a DRIP,

you put the full $600 to work for you, compounding all the way, increasing your

crop yield.

This is the true power of

dividend reinvestments. Additionally,

you’re assured of automatic contributions to your portfolio each month. Efficient, disciplined investing maximizing

your ability to grow a healthy dividend crop.

Who doesn’t like that?

The thoughts and opinions

expressed here are those of the author, who is not a financial

professional. Opinions expressed here should not be considered investment

advice. They are presented for discussion and entertainment purposes

only. For specific investment advice or assistance, please contact a

registered investment advisor, licensed broker, or other financial

professional.

No comments:

Post a Comment