The November Dividend Farmer

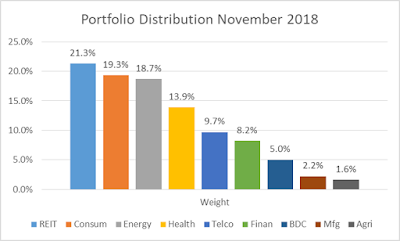

update saw a shift in portfolio weight relative to October. Changes to weights at the bottom end of the basket

were attributable to the addition of 100 shares of a telco. Conversely, changes to weighted position at

the top end were due mostly to REIT holdings all paying dividends,

automatically reinvested, during the month.

In monitoring news articles and blogs no issues were found to

be overly concerning regarding my holdings.

Once again, I’m not checking ticker symbols on a regular basis since my

focus is on building the dividend income stream rather than market value. Consequently, I try to focus on substantive

issues adversely affecting the abilities of the investments to generate cash and

didn’t find any in headline.

In monitoring news articles and blogs no issues were found to

be overly concerning regarding my holdings.

Once again, I’m not checking ticker symbols on a regular basis since my

focus is on building the dividend income stream rather than market value. Consequently, I try to focus on substantive

issues adversely affecting the abilities of the investments to generate cash and

didn’t find any in headline.

The yield relative to current price bumped up from 3.82% in October

to 3.84% in November due to the addition of the telco stock with an individual

yield sufficiently high that it moved the portfolio yield ever so slightly. All dividends are automatically reinvested

with no transactions fees. Unweighted

average yield on cost is about 4.6%; nearly 1% higher than the current yield on

price of 3.84%.

The average monthly dividend from this basket has now

surpassed $1,100 – by a few bucks. That doesn’t

pay all the bills, but it is nice supplemental income if needed. The trailing 1-year CAGR ballooned from 10.6%

to 12.6%. In looking at past history,

jumps like these appear to coincide with dividend increases announced by

multiple holdings in a single month.

Each month accelerates the income stream growth through the power of

compounding. The Compound

Growth post offers more detail about the power of compounding your

dividends through automatic reinvestment.

The thoughts and

opinions expressed here are those of the author, who is not a financial

professional. Opinions expressed here should not be considered investment

advice. They are presented for discussion and entertainment purposes

only. For specific investment advice or assistance, please contact a registered

investment advisor, licensed broker, or other financial professional.

No comments:

Post a Comment