The previous post noted that

1%

is bigger than you think relative to your dividend stream and the

period of time required for it to double in size.

The concept involves

compound

annual growth rates (CAGR) and the

Rule

of 72.

I finished by saying I’d share ways to increase the compound

growth rate of a div stream by at least 1%.

Here goes…

Transactions Costs

There are two items involved here. One is the actual cost of buying a

stock. The other is a function of

investment size and frequency. I’ll take

cost first.

Cost: Brokerages have charged $4.95 to $40 per

trade over the years. Given $500 to

invest, spending $4.95 of it to make the trade puts roughly $495 to work in the

portfolio. Conversely, spending $40 on a

trade gets $460 into a portfolio putting it $35 (7%) behind. And it’s not even out of the investing

gate.

|

| Cut Your Transactions Costs |

Another way to look at it is to assume a 10% dividend (makes

the math easy) on the $460 portfolio which yields $46.00. However, reducing transactions costs from $40

to $20 through a discount broker, means $480 in the portfolio and $48.00 in

dividends at the end of the year. The $2

dollar increase from $46 to $48 represents a 4% increase in my growth rate. This doesn’t sound like much, but if you’ll

recall the last post, it can make a heck of a difference.

Investment size and

frequency: Breaking an investment

amount into multiple smaller increments vs pulling the trigger on one large

stock purchase can make a difference as well.

Assume a $500 investment figure.

If it’s split across 5 purchases of $100 each with a brokerage fee of

$4.95 per trade it means spending $24.75 on those stock buys.

However, saving your powder and investing all $500 in a

single trade, means spending $4.95 netting an additional $19.80 going to work in

a portfolio rather than a broker’s pocket.

That $19.80 provides a 4.9% head start that widens further with

time. Trading often in small amounts

puts a sneaky big dent in the compound growth rate.

It’s good to be aware of trade-offs on this point.

Spreading amounts across multiple smaller

purchases is how some investors prefer to diversify.

Diversification

is helpful, but the law of diminishing returns on risk reduction kicks in

quickly.

Weigh diversification needs against

transaction cost reduction to determine which route is a better fit.

Portfolio Yield

As with transactions costs there are a couple ways to

approach this.

|

| Portfolio Yield |

Whole portfolio

yield: This is easy to explain, but

difficult to pull off. If the stocks in a

portfolio are each paying 4%, trading them all in for similar stocks paying 5%

results in a 1% increase in the rate at which the dividend stream compounds. This is easy but assumes no transactions

costs or capital gains taxes are involved.

Beyond that drag, finding a basket of 5 percenters meeting the investing

criteria of the 4% stocks they are replacing is challenging. Consequently, the next method is more

realistic.

Portfolio mix and

weighted average: This method takes

analysis and is helped by the use of

Excel.

The following example is an over

simplification, but it demonstrates the point.

Let’s assume a portfolio of $1000 paying 4% produces a dividend stream

of $40.

Split $50 (5%) from that $1,000 and

invest it in a stock paying 8%, which is possible.

The $950 investment paying 4% yields $38 and

the $50 investment paying 8% yields $4 for a total of $42.

The additional $2 is a 5% increase over $40 otherwise

available.

Please note some investors consider allocating dollars to

high yield stocks a way of introducing additional of risk – and rightly

so. However, a small amount of risk may

be acceptable for investors as long as the additional risk is applied to a

small segment of a portfolio that’s big enough to move the weighted average and

increase the dividend stream by 1% or more.

This is one of those times when knowing your risk tolerance is

important. So is understanding the

concept of opportunity – cost which is required to weigh the added risk against

the added growth.

Dividend growth stocks

|

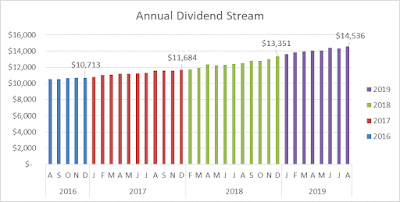

| Dividend Dollars Multiply |

These are a favorite of value investors. Buying offerings in this category, particularly

those with long records of growth, means raising the dividend paid nearly every

year just by holding the stock. Here’s

an example of what that can mean.

Two portfolios of $1,000.

Both pay a 4% dividend. Portfolio

A does not raise its dividend while Portfolio B does so in small increments,

say 3%, each year. “A” delivers $40 year

after year assuming no reinvestment.

However, “B” delivers $40 the first year and $41.20 the second year

assuming no compounding.

As you may have guessed, portfolio B grows the dividend

stream by 3% relative to portfolio A.

Imagine what this delta can do over many years as the investment

portfolio grows? Think about what

happens if this growth compounds along the way because all dividends are

reinvested? Dividend growth is powerful. It takes patience and persistence. It’s worth it.

There are several methods

Dividend Farmers

can use to increase the CAGR of their dividend cash flow.

These options don’t require exceptional skill

or the addition of great risk.

Better

still, they can be stacked to compound the compounding.

Reducing transaction costs, purchasing

dividend growth stocks, and mixing in a pinch of high yield stock with a long

history of steady payments can add 1% or more to the growth rate of your dividend

income stream.

Thoughts expressed here are

those of the author, who is not a financial professional. These opinions

should not be considered investment advice. They are presented for

discussion and entertainment purposes. For specific investment advice or

assistance, please contact a registered investment advisor, licensed broker, or

other financial professional.