The February Dividend Farmer

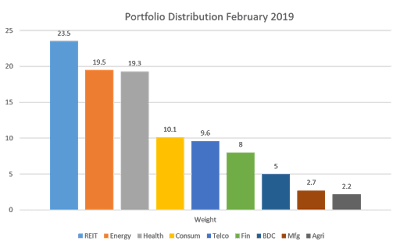

update offers no significant changes relative to the January distribution. There were no new additions or subtractions

to the portfolio during the month. REIT

holdings continue to lead the portfolio weight.

Although I’ve reviewed a couple of firms that might be additive to the

manufacturing sector, no new holdings have been acquired.

Overall, a few segments moved up or down a tenth of a

percentage point, but the portfolio has held steady in terms of segment

distribution. None of the holdings

experienced significant events, good or bad.

|

The yield relative to current price dipped from 3.94% in January

to 3.9% in February due to portfolio value increases which drove the numerator higher

in the yield ratio.

All dividends are automatically reinvested with no

transactions fees. Unweighted average

yield on cost also dipped to 4.4% as newly reinvested shares purchased at

higher rates advance the average cost of shares in the portfolio. However, yield on cost remains a full half a

percentage above the current yield on price of 3.9%.

The average monthly dividend growth from this basket continues

moving upward standing now at just above $1,160. The trailing twelve month growth rate fell to

13.1% due to the fact that February is a fairly light month for dividend payments

in this particular portfolio. All the

same, the dividend stream growth rate would double in about 5.5 years and is

still comfortably above the desired 10% figure I’d like to maintain.

Each month generates additional income stream growth through

the power of compounding in a slow, steady manner. The Rule

of 72 post offers further detail about the power of compounding. The remarkable thing about compound growth is

that if you’re patient you’ll eventually reach a point at which critical

mass is achieved and growth in your dividend stream takes off. That’s why this Dividend

Farmer is an advocate of dividend investing.

The thoughts and

opinions provided are those of the author, who is not a financial

professional. Opinions expressed here should not be considered investment

advice. They are presented for discussion and entertainment purposes

only. For specific investment advice or assistance, please contact a

registered investment advisor, licensed broker, or other financial

professional.

No comments:

Post a Comment